Off Plan Guide - Overview

The term ‘off plan’ refers to properties that are under the construction phase. Whether it’s a fantastic location, a stunning layout, or a designer brand affiliation, these projects offer lucrative investment opportunities.

Guides to buying a off-plan property in dubai

Location & Developer: Start by researching the area where you want to invest and select a reputable developer with a proven track record. Popular developers in Dubai include Emaar, Damac, and Nakheel.

- Property Type: Choose the type of property you want (apartment, villa, townhouse) and the size based on your budget and preferences.

- Future Prospects: Consider the project's location, development plan, amenities, and potential for future capital growth.

- License & Registration: Ensure that the developer is registered with the Dubai Land Department (DLD) and is part of the Real Estate Regulatory Agency (RERA). This guarantees the project is legitimate and follows local laws.

- Past Projects: Research the developer’s past projects and reviews from previous buyers to ensure they deliver on time and maintain quality.

It’s advisable to work with a real estate agent who specializes in off-plan properties. They can help you find the right property, negotiate deals, and ensure all paperwork is in order.

- Payment Schedule: Developers typically offer flexible payment plans. Most require an initial deposit, followed by staged payments linked to construction milestones.

- Financing Options: While many developers offer financing options, you can also secure a mortgage from a bank. Ensure you understand the terms of the payment plan before proceeding.

- Once you’ve selected the property, you’ll need to sign a Sales and Purchase Agreement (SPA). This legally binding document outlines the terms of the deal, including the price, payment schedule, and delivery date.

- Initial Deposit: You’ll usually need to pay an initial deposit (5-10% of the property price) upon signing the agreement.

- The property transaction must be registered with the Dubai Land Department. Both parties (buyer and developer) sign a contract and the buyer receives an official registration certificate, which acts as proof of ownership.

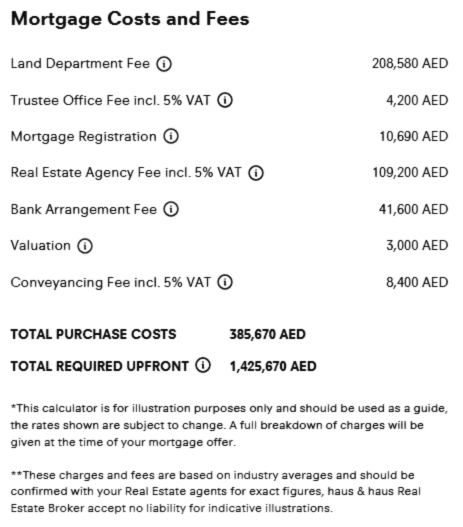

- DLD Fees: You’ll need to pay registration fees, usually 4% of the property value, along with any administrative costs.

- As the property nears completion, ensure that the final payments are made according to the payment plan.

- Once the property is ready, the developer will arrange a handover process where you’ll inspect the property to ensure it matches the agreed-upon specifications.

- You’ll also receive the title deed after full payment and registration with the DLD.

- Stay updated with the progress of the development. Developers usually provide periodic updates, and you can also visit the site to monitor construction.

- Completion Date: Make sure to confirm the estimated completion date and ensure that any delays are communicated to you by the developer.

Latest Projects in Dubai

admin1122

3 weeks ago

admin1122

7 months ago

admin1122

7 months ago

admin1122

7 months ago

admin1122

7 months ago

Frequently Asked Questions (FAQs) - OFF PLAN GUIDES

Find Your Consultant

Get Personalised assistance from our dedicated team

of experts.

- Call Us

- Mailing Address

Follow us

Testimonials

“

I had the pleasure of working with Outlook Properties and their outstanding broker, Mohammed Khalid Yousuf Choksy, and I couldn't be happier with the level of service I received. Mr. Khalid truly went above and beyond to assist me in finding the perfect property.

Luliia Vlasova

“

My wife & I have moved 6 times in the last 25 years. Obviously, we've dealt with many realtors both on the buying and selling side. I have to say that Outlook Properties is the BEST real estate agency we've ever worked with, their professionalism, attention to detail and responsive

Alji Kabul

“

An amazing 5 uears of tenancy experience with Outlook Properties. Never encountered same of a kind team and company. Thank you so much for the great, professional, efficient, and honest service all the way... Always felt I am in safe hands...

Ahmad Chehouri

“

Outlook properties were very professional and on point. They were helpful and made this a very smooth process for me, they delivered what I asked for. I would Highly recommend their service.

Ghani Mohammed

“

An excellent drive, Outlook Properties have been helping me with the updates on the real estate in Dubai for more than a year, and this made it easy for me to purchase a house in Dubai. They are top-notch professionals. I recommend working with her to everyone.

Scarlet Reborn

“

Great support and assistance for property purchase. Really appreciate the way Outlook properties stood with me for my first home.